Contents:

The image illustrates the way the Gann Grid indicator works. The thick black line is the base movement we take for our grid. At the beginning and the end of the plotted black line, we have the two bottoms that form the base. As you see, the size of the black line equals the size of each side in the blue rectangles.

- Finally, the 2X1 moves two units of price with one unit of time.

- There is a big difference between forecasting prices and trading.

- If the price holds below the descending line, bears are having the upper hand.

- The price started off rising along the 8×1 angle, going up to test the 2×1 angle and falling back to the 4×1 angle.

One of the controversies of Gann theory is that the past, present and future all exist at the same time on a Gann angle. He believed that angles could be used to identify key levels of support and resistance,… The Gann theory, developed by trader and market expert William Delbert Gann, lays down helpful trading strategies that can help to earn attractive profits through trading. It is a popular theory among traders and has evolved to be a set of powerful tools for technical analysis.

Trend Deciding Level: 532

Bramesh Bhandari has been actively trading the Indian Stock Markets since over 15+ Years. His primary strategies are his interpretations and applications of Gann And Astro Methodologies developed over the past decade. Your stops should be located above/beyond the previous top/bottom on the chart. Now that you know when to open Gann trades and how to protect them, we will discuss some trade management ideas. In any type of leveraged trading, you should use a stop loss in order to protect your account. Here are some ideas to consider for placing stop loss orders when trading with Gann Line Breakouts and Bounces.

The blue arrows on the chart indicate the moments when the price action finds support/resistance within the Gann Grid. As you see, the price action interacts with the gird in a similar way as illustrated earlier with the Gann Fan. We also have breakouts in the levels, which can signal potential price moves in the direction of the breakout. Traders can benefit immensely from Gann’s theory because of its technical analysis capabilities.

Early life of W.D. Gann

Traders are usually only taught to focus on price, but the problem is that not many people talk about the time axis. From a practical point of view, traders lose in most of their trades because they don’t know how to enter the market at the right time. To be a successful trader, you must have a trading plan and a strategy that will establish parameters on which you should base your operations.

In this case you can safely apply the ratio of 1 USD – 1 degree. Since Gann worked in the US commodity markets, where all prices were quoted in dollars and their price was much higher than 1 USD or 2 USD, the problem was solved quite simply. Consequently, the product price that was more than 360 USD was converted into longitude very simply. As my experiment proves, this event doesn’t always influence the market. Therefore, it is better when a twin or a multiple planetary ingress is confirmed by other astrological signals, or by tools of technical or mathematical analysis. When I change the date in Cosmogram, you’ll see that the planet symbols move clockwise on the Protractor.

If you have a long-term chart, you will sometimes see many angles clustering at or near the same price. The more angles clustering in a zone, the more important the support or resistance. Another way to determine the support and resistance is to combine angles and horizontal lines. For example, often a down-trending Gann angle will cross a 50% retracement level. This combination will then set up a key resistance point. A Gann Grid is another tool which can be used to indicate price movement, and is plotted by placing a series of intersecting 45-degree angle lines over a price chart.

On the other hand, when you determine your stop loss before entering the market, you’re able to make an unbiased decision about its placement. This allows you to stay disciplined by trading what the market is doing versus what you want it to do. He knew that becoming a consistently profitable trader means taking large profits and small losses. There are several reasons why this is true, but most important is the fact that a losing position is a sign that your analysis may not have been correct.

We take profit at the earliest sign of market weakness, which is a break below the 1/1 line, which signals a possible beginning of a bearish trend. To eliminate the possibility of a false breakthrough, we add 20 points to the breakthrough of the Gann angle 1/1. The next step is to select the key high or low price on the chart from which you will draw the Fan Gunn corners. For example, you select the maximum, as in the figure above, then you use the Trend Angle tool and draw an ideal angle of 45 degrees. As William Gunn himself said, the reasons for his success are the cyclical nature of time, history and markets.

However, critics argued that there’s no concrete proof he ever made a great fortune from his predictions. A trend line is a chart pattern that is defined as a series of highs or lows that form a straight line. It is constructed by joining two or more price points with a straight line.

The descending triangle is a chart pattern used in technical analysis. The pattern usually forms at the end of a downtrend but can also occur as a consolidation in an uptrend. A Gann angle is thus a diagonal line that moves at a uniform rate of speed. A trendline is created by connectingbottomsto bottoms, in the case of an uptrend, andtopsto tops, in the case of adowntrend.

Once the decision has been made, it must be translated into reality. Therefore, we will give the broker the order to sell at such a stop price. It can be above 95, but most often, it will be slightly below. But in this case, the market will likely experience a sharp decline, and you will be among the first to exit. Working with stop loss orders was very important to Gann. According to him, the most frequent losses were the consequence of over-trading and a lack of stop loss.

Kotak Bank

Everything has happened before and will eventually repeat itself. He studied ancient texts to investigate how market events and particular numbers repeated across different time cycles. Gann from the early 1900s, all the way to his death in 1955. These trading strategies have stood the test of time and are still one of the most successful trading strategies. Move stop to Break Even and Target major resistance or price closes below Gannor OBOS givessell signal.

W.D. gann trading strategy was a trader and market analyst in the early 20th century who developed various technical analysis tools, including the Gann Fan. His trading theories and strategies are still widely used today. One of the main reasons why Gann fan angles are superior to the horizontal support and resistance levels is that financial markets are geometric in their movements.

How to use the Gann Fans strategy? Gann Fans’ strategy trading rules

According to the current trend, Gann found that every one of these angles provides useful information about the resistance and support levels. When an uptrend is underway, a 1×1 angle offers a significant hint of support; alternatively, prices dropping just under the 1×1 angle may indicate a reversal. When this decrease happens, the costs will probably fall. According to Gann’s theory, when one angle line inside the fan breaks, there will probably be movements to and stability at the subsequent angle line. It can be applied to all markets because, according to Gann theory, financial markets move as a result of human behavior. In other words, history is a good predictor of future price changes.

Providing you with access to some of the most exclusive, game changing cryptocurrency signals, newsletters, magazines, trading indicators, tools and more. Stretching the Gann box to the right will make the 0.382 time cycle align with the price level of the previous day. Perhaps, one of the drawbacks of such an analysis is that it is complex and long process.

We do have DT Tutorials to teach you how to use the DT Gann Module, but we do not provide educational material about Gann geometric chart analysis and trading techniques. I hope this article has helped shed some light on how WD Gann traded and how these twenty rules can be applied to your own trading to make you a more well-rounded trader. Revenge trading is one of the most deadly sins a trader can make. With more information comes confusion, especially when the majority of that information is born from trading forums where everyone is an “expert”. These traders like to share their own convictions, which on the surface is harmless, but when other traders trade based on those convictions it can be disastrous.

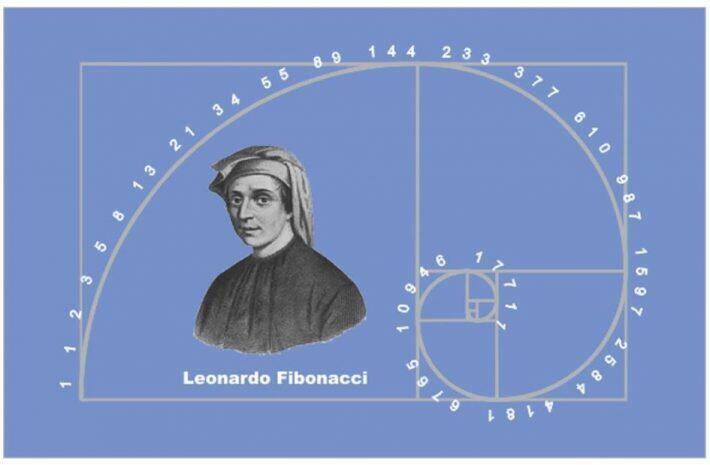

Read also the article «Fibonacci https://traderoom.info/ – how to use in trading?». Just follow the simple rules on how to use the Gann fan, and use steps 1 and 2 to identify the sales transaction, and then go to steps 3 to 5 to manage the transaction . You need to again use the Fan Gun indicator to a minimum of oscillation before breaking above 2/1 of the Gun fan angle. At this point, you can remove previous Gann corners so you don’t clutter the chart. Now you know how to build a Fan Gann, and you can move on to the most important part of this article – the rules for trading the Fan Gann strategy. The image starts with two tops, which are directed downwards.

TD Ameritrade Announces thinkorswim® Enhancements – Business Wire

TD Ameritrade Announces thinkorswim® Enhancements.

Posted: Tue, 31 Jan 2023 08:00:00 GMT [source]

Just read Support and Resistance Zones – Road to Successful Trading. Gann indicators are based on the notion that markets rotate from angle to angle and when an angle is broken, the price moves towards the next one. This is why I always say that learning to use price action is essential to your success as a trader, regardless of the trading strategy you end up using.

What Is Price Action Trading? 3 Price Action Charts Explained – MUO – MakeUseOf

What Is Price Action Trading? 3 Price Action Charts Explained.

Posted: Fri, 25 Nov 2022 08:00:00 GMT [source]

In the ancient Chinese calendar, we have a solar term called the “little winter” , a day when the sun moves through 15 degrees Capricorn. It is often the coldest day in the year or within +/- 15 days. Think of the metal balls swinging pendulum; it shows the law about conservation of Momentum and Energy. The energy runs through the balls, affecting how far the metal balls fly. The same applies to the energy stored in the price of the candles. The power of each candle is ruled by the amount of momentum energy remaining in it.